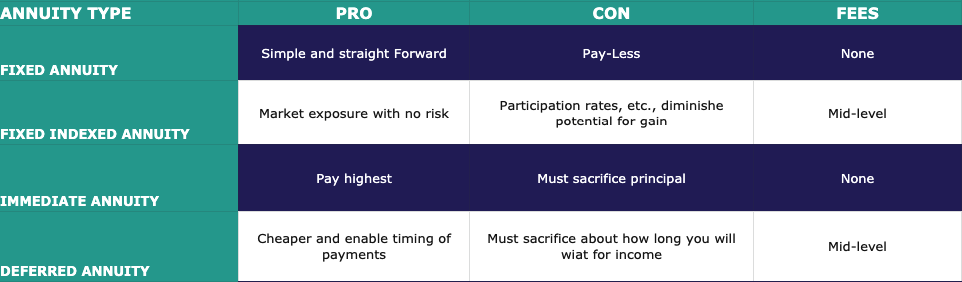

Annuity Types

FIXED ANNUITIES

These are fixed interest investments which help protect you from the risk of outliving your income. Fixed annuities are tax-deferred and pay guaranteed rates of interest, typically higher than bank CDs. These are issued exclusively by insurance companies and allows you to defer income or draw income immediately. This product is a popular for those who are retired and preparing for ritirement. Fixed annuities are for those seeking a modest, no-cost, guaranteed fixed investment.

Learn MoreFIXED-INDEXED ANNUITIES

These are essentially fixed annuities that have a variable rate of interest based on the movement of an index, such as the S&P 500. This type of annuity gaurantees a return and also allows the holder to benefit from stock market gains without having to assume the full risk of a downturn in market prices. One potential drawback is that increases in the market can be capped on the annuity return due to what are called a participation rate, spreads or caps. This is a good option for retirees or those preparing for retirement that want to participate in the market with mitigated risk and downturn investment protection.

Learn MoreIMMEDIATE ANNUITIES

This type of annuity essentially mirrors the idea of life insurance. Whereas on a life insurance policy, the policy holder pays the insurer and premium and in return the beneficiaries recieve a lump sum of money upon death of the insured. This works in the opposite direction where the annuity investor pays the insurer a lump sum of money up front and in return the insurer makes montly income payments to the holder of the annuity for a specified period of time typically beginning 1-12 months after the investment is recieved. This option often results in higher income payments compared to other annuities due to recieving principle, as well as interest. This is a good option for retirees and those preparing for retirement that are willing to sacrifice principle up front in return for a higher lifelong stream of income when in comparison to other options.

Learn MoreDEFERRED ANNUITIES

Deffered annuities delay the beginning of income payment at least 12 months and allows people to increase their income stream later in life for less money. This is due to the idea that the holder of the annuity who may want to continue to work in retirement but plans on stopping at some point and knows that they will need the gauranteed income at that point and not before then. This is a good option for retirees or those preparing to retire that plan to continue working to some degree but know that they will need annuity income at some point in the future.

Learn More Learn More